Homeowners insurance washington state provides peace of mind for homeowners who want to protect their property from financial loss. A policy may help replace items lost and repair damage to your home. You should also protect your home and belongings from natural disasters that can be expensive.

Washington's home insurance prices vary a lot, so shopping around is essential to find the lowest price. You'll need to find a company that can meet your specific needs, which includes choosing the right coverages and add-ons.

The Average Cost of Homeowners Insurance in Washington

Rates in the state are on the lower end of the national average, but they are increasing due to the fact that natural disasters are becoming more frequent and expensive. It doesn't matter whether you live a quiet rural area or in a busy urban center, homeowners insurance will protect your biggest investment.

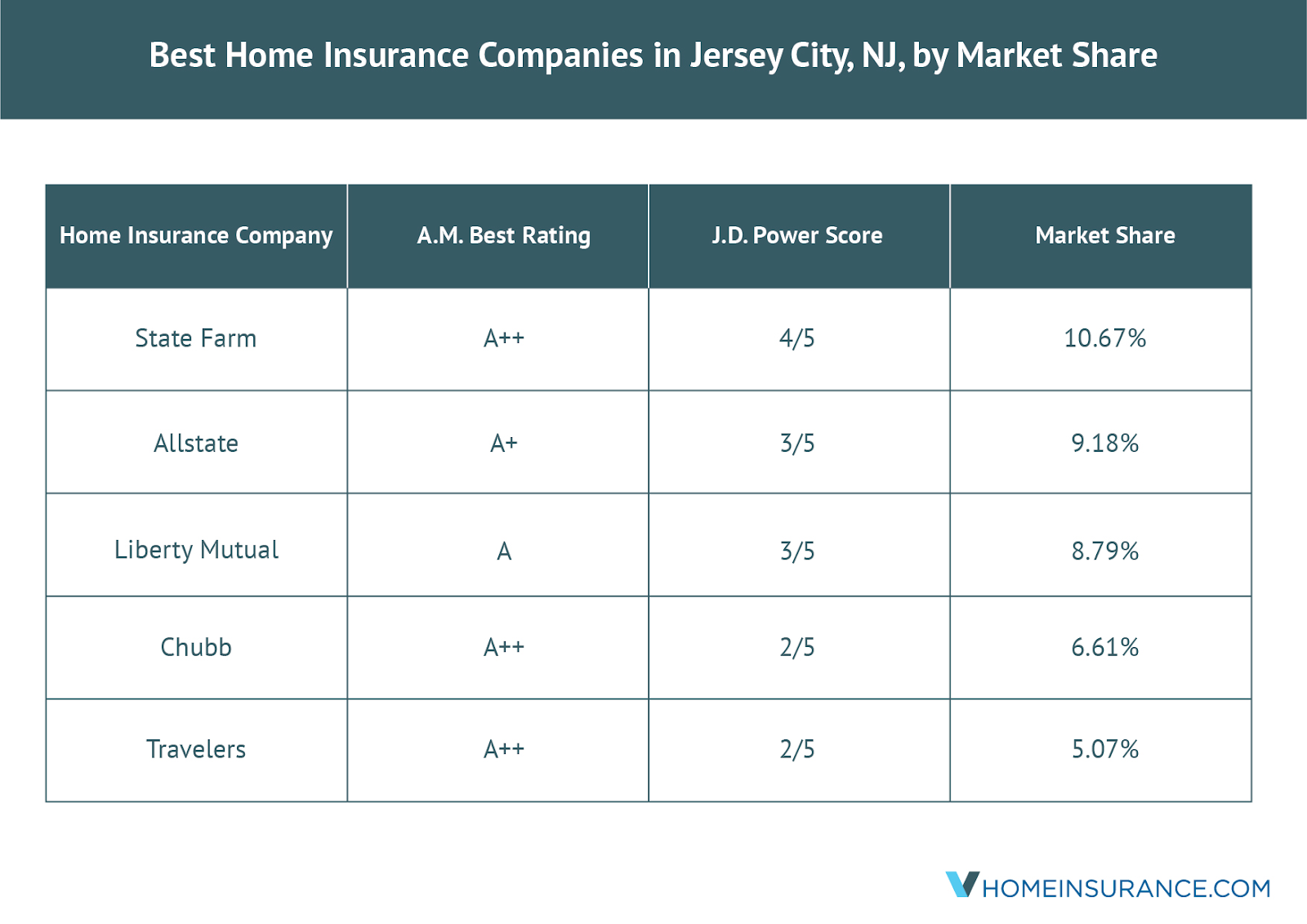

The Top Five Home Insurance Companies in Washington

There are many different home insurance companies and each assesses the risk differently. By comparing prices, you can find the most affordable company.

Insurers also offer discounts and rewards for customer loyalty. Those who stick with the same insurer for years may receive discounts based on their history of claims-free behavior or installing safety devices like burglar alarms or fire- and water-suppression systems.

Comparing homeowner's coverage with the major insurers is a good place to start. These large companies offer extensive networks as well as the expertise to provide reasonable rates and a high level of insurance.

These five tips will help you find the best homeowners insurance.

Compare quotes and coverages from different companies. Look for a multipolicy discount when you bundle your home insurance with your car and life policies.

Set a high deductible, so you won't have to pay for damage not covered by your policy. You will save money and be discouraged from filing small claims which will raise your premium.

You can get extra coverage from your insurer, like flood insurance or liability insurance. These types of insurance will cover the costs associated with repairing or replacing your home, your possessions and any other structure on your property that isn't covered by your standard homeowners policy.

USAA provides home insurance for military personnel with many features that other companies do not offer. Included are waived deductibles when military-issued equipment is lost or damaged, as well as coverage for war zones abroad.

This company is well-known for their excellent customer service. They are also one of America's top-rated home insurers. The company is one of only a few insurers that offer a discount for automatic payments. This can reduce your monthly premiums by up to 25 percent if you have your credit card or bank account set up automatically.