Multiple trip travel insurance plans may be a good idea if you travel more frequently than once a month. These plans can be great for many reasons. These plans are affordable and provide the security you need to enjoy your vacation. At affordable rates, you can purchase multiple trip plans for your family or individual.

Multiple-trip travel insurance offers many benefits

Multi-trip travel insurance plans are a great way to save money. It provides comprehensive coverage for multiple trips and allows for streamlined coverage. Multi-trip policies are simple to purchase and can help you save time and hassles. Multi-trip travel insurance means that you only have to purchase one policy per year, rather than buying separate policies each time.

Multi-trip policies can be convenient for those who plan to take a few trips per year. You have the option to extend your coverage for as many days each year as you like. You can extend your coverage to cover longer trips, like trips out of Canada. Additionally, you can add more days to each trip as long as your total coverage is not exceeded 365 days.

Multiple-trip travel insurance policies: What is the cost?

A multi-trip travel insurance policy can be less expensive than purchasing a single-trip policy. This type of policy usually covers travel delays as well as emergency medical and evacuation benefits. Some policies include trip cancellation and interruption coverage. Consider purchasing a single trip policy if the cost of your trip is not the same each year.

Some plans cover extra expenses such as emergency cash transfer or a higher medical limit. Other plans provide additional protection, including lost luggage coverage. You can customize your plan with the additional coverage.

Types of multi-trip travel insurance plans

Multi-trip travel insurance plans are ideal for frequent travelers and spontaneous jetsetters, and offer a wide range of coverage. These plans offer trip cancellation and delay insurance, as well as medical evacuation. Many plans also provide coverage for pre-existing medical conditions. Before you make a purchase, compare the policies.

A multi-trip policy is the best option for frequent travelers. It costs less than purchasing insurance for individual trips, and it pays for itself in just a few trips. It's also much more convenient than purchasing separate policies each time.

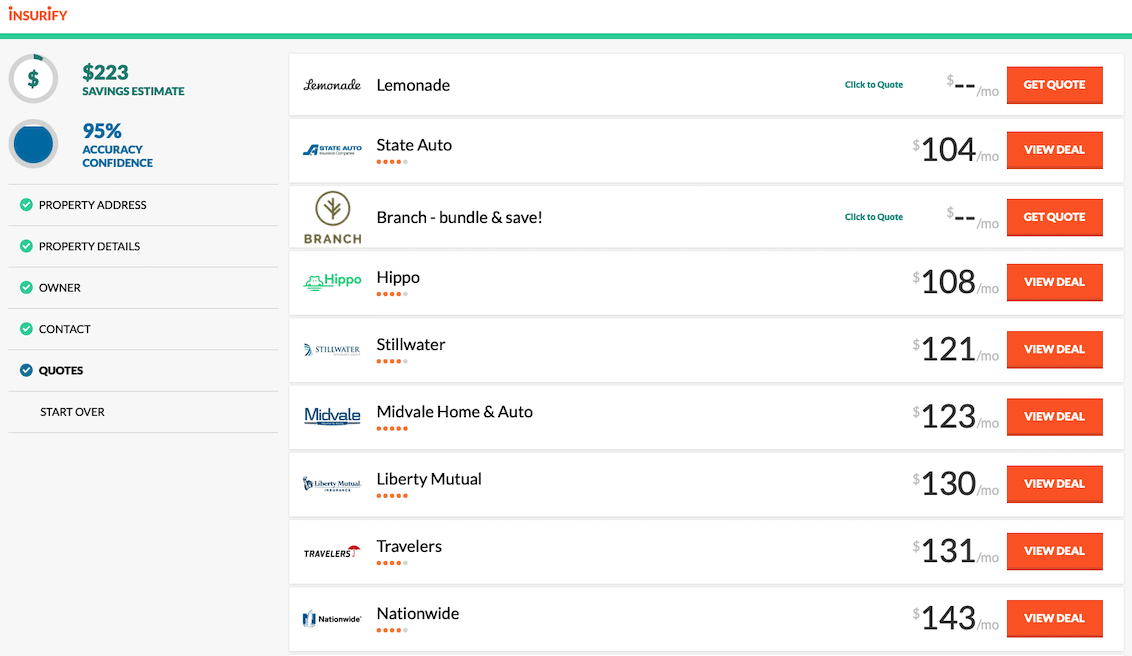

Comparison of multitrip travel insurance plans

Consider multi-trip insurance plans. It is important that you understand the limitations and exclusions of each policy when looking into multi-trip insurance plans. Remember that your needs should be considered when choosing the right coverage. This article gives you an overview of some of the benefits available in travel insurance policies. You should still check each certificate for additional details.

If you plan on traveling frequently and taking multiple trips within a single year, you might consider an annual travel policy. This policy will help you save time especially if your plans include multiple trips. The best part is that you will only need to apply once and pay one fee. This plan is ideal for frequent business or pleasure travelers.