What is a homeowner's insurance premium?

A homeowners insurance is the amount that you pay to your insurer to cover costs for repairing or replacing the home in the event of a covered accident. It can be paid either monthly, quarterly, or annually.

What is the cost of home insurance?

A home insurance policy is the amount that you pay in premiums to an insurer to cover costs for repairing or replacing a building, along with its contents and structural elements, if it gets damaged. It is also called a homeowner's policy or a dwelling coverage policy.

How do you get a low homeowners insurance premium?

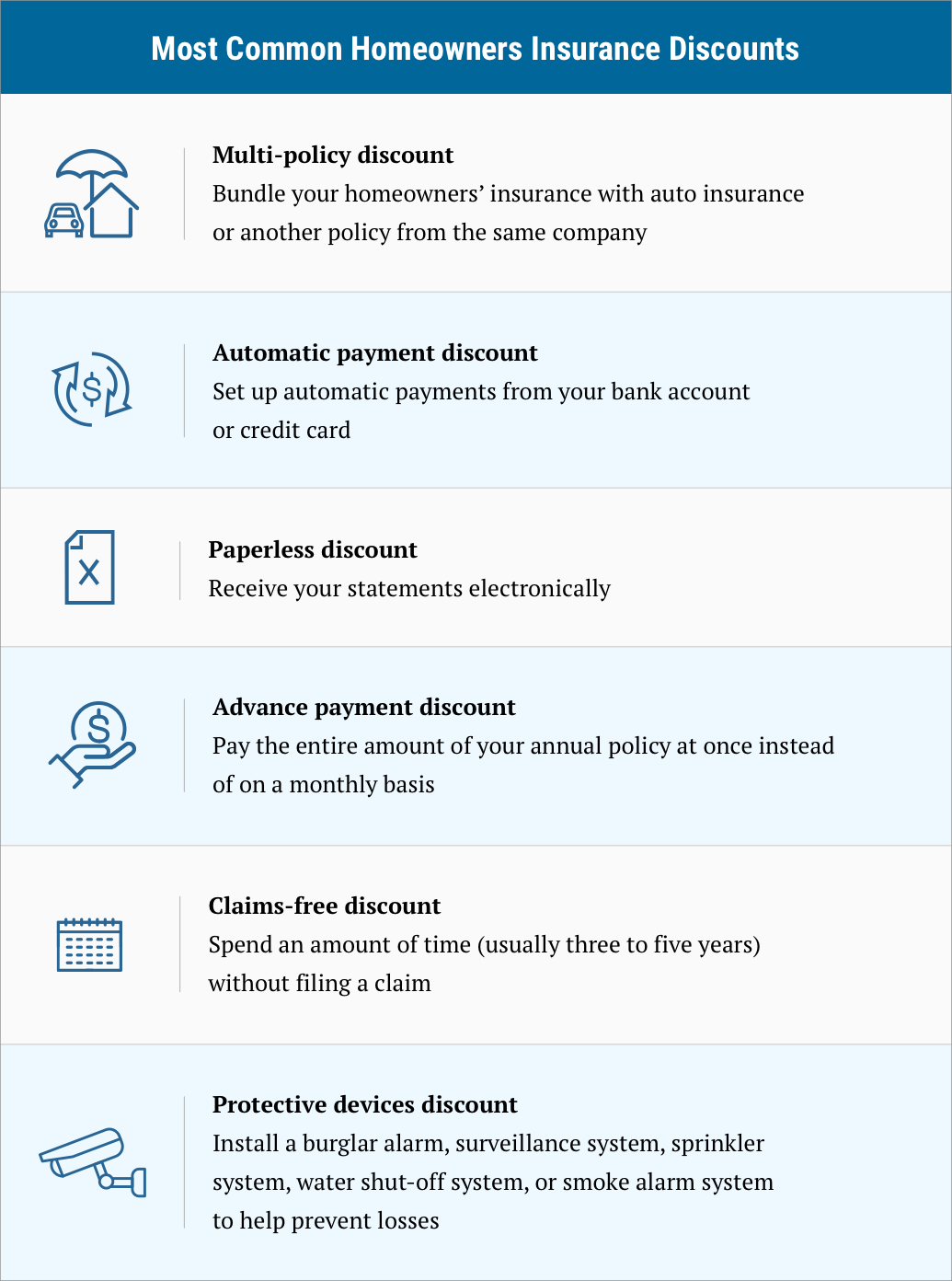

Reduce your claim risk to lower the cost of your homeowners insurance. These include reducing the amount of coverage you have on your house and adding safety features to your home, such as burglar and fire alarms.

What factors determine the cost of your homeowner's insurance?

The location and size of your home are two of the main factors that determine your homeowners insurance rates. Your homeowners insurance premiums will likely be higher if your house is located in a place with a high crime rate or an area susceptible to flooding or earthquakes.

In addition to the age and type the structure, the materials used in its construction can also influence your homeowners insurance rates. Your insurance rates will be higher if your home is older and made of wood frames.

Your homeowners insurance rate can also be affected by the length of time that you have insured your home. If you've been insuring your home for more than five years, you can expect to see an increase in your premium, even if you haven't filed any claims yet.

New homeowners may qualify for discounts on their home insurance. It is based on the age of your home and your credit rating. This can result in a substantial savings.

A pool in your backyard or multiple pets may increase your insurance rates. If you have a swimming pool, it's important to add a fence and other safety features around it.

A home in poor or old condition will also likely result in a higher homeowners insurance rate than a more recent home. This is because an old, poorly-maintained house can be a bigger risk for an insurer than an energy-efficient, brand-new home.

What are the most common ways that you can lower your homeowners insurance premium?

If you want to lower your homeowners' insurance premium, you may consider lowering your coverage, increasing your deductible or making other policy modifications. These changes allow you to reduce your insurance premiums without having to significantly reduce the protection that you are provided with.